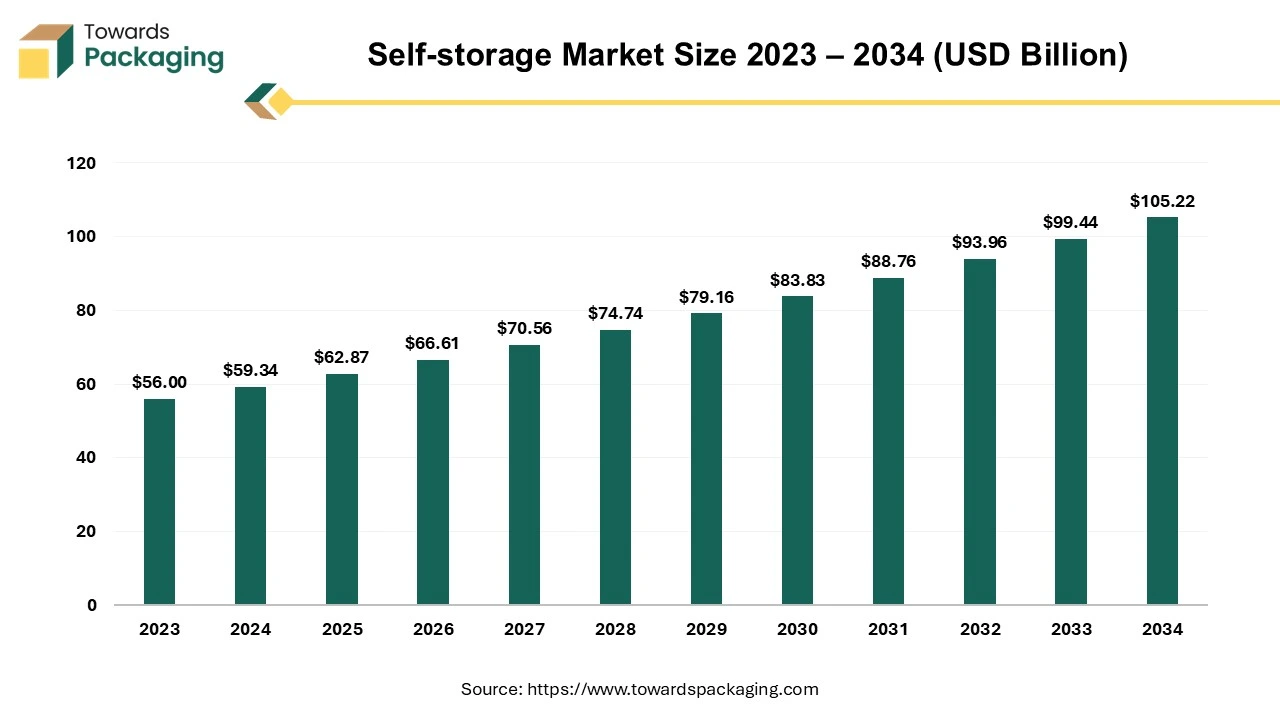

Self-storage Market Size to Skyrocket USD 105.22 Bn by 2034 | Packaging Experts Analysis

According to Towards Packaging consultant, the self-storage market size stood at USD 59.34 billion in 2024 and is predicted to exceed USD 105.22 billion by 2034, experiencing a CAGR of 5.95% from 2024 to 2034.

/EIN News/ -- Ottawa, May 05, 2025 (GLOBE NEWSWIRE) -- The self-storage market size to record USD 62.87 billion in 2025 and is projected to grow beyond USD 105.22 billion by 2034, a study published by Towards Packaging a sister firm of Precedence Research.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardspackaging.com/download-brochure/5494

Market Overview:

Self-storage refers to a service that allows individuals or businesses to rent secure, private storage spaces such as lockers, rooms, containers, or outdoor space on a short-term or long-term basis. These storage units are typically located in a facility managed by a self-storage company. The key features of self-storage service are to give access control and to give security for storage. The customers usually have their own key or code to access their unit. Facilities often have surveillance cameras, fencing, and on-site personnel. The self-storage offers flexibility, units come in various sizes and can be rented month-to-month. Commonly used during moves, renovations, downsizing, or for storing business inventory or seasonal items.

Major Applications of Self-storage:

- Self-storage is a service that provides individuals and businesses with access to secure, rented spaces to store their personal or commercial belongings. These spaces, known as storage units, are typically housed within large storage facilities operated by private companies. Self-storage units come in a range of sizes, from small lockers suitable for storing a few boxes to larger rooms capable of holding the contents of an entire household or office.

- One of the defining features of self-storage is flexibility. Most self-storage facilities offer short-term, month-to-month rental agreements, allowing users to rent a unit for as long, or as briefly as they need.

- This makes self-storage especially popular during life transitions such as moving, downsizing, renovating a home, or dealing with inherited belongings. It is also increasingly used by small businesses for storing inventory, equipment, or documents that do not require office space.

Recent Consumer Demand Shifts for Self-storage Products:

Customers typically bring their items to the facility themselves and manage their own unit. The units are accessible during designated hours, and many facilities offer 24/7 access. Security is a major feature of self-storage. Most locations are equipped with surveillance cameras, gated access, individual unit locks, and sometimes on-site personnel, ensuring that stored belongings remain safe.

The growth of the self-storage industry has been fuelled by urbanization, rising real estate costs, and changing lifestyles that demand more flexible living spaces. It provides a convenient, cost-effective solution for people who need extra room without having to move or invest in larger living or office spaces.

Major Key Trends in Self-Storage Market:

-

Technological Advancements and Automation

Self-storage facilities are increasingly integrating advanced technologies to enhance operational efficiency and customer experience.

-

Smart Access Systems

Implementation of biometric access controls, smart locks, and AI-driven surveillance enhances security and provides customers with seamless, 24/7 access to their units.

Streams Development

-

Cloud-Based Management

Adoption of cloud-based platforms allows for streamlined operations, enabling customers to manage bookings, payments, and account details online.

-

Artificial Intelligence (AI)

AI is being utilized for dynamic pricing strategies, predictive analytics, and personalized customer interactions, optimizing both revenue and user satisfaction.

-

Emphasis on Sustainability

Environmental considerations are becoming central to self-storage operations:

-

Expansion of Mobile and On-Demand Storage Solutions

The demand for flexible storage options has led to the rise of mobile self-storage services:

Portable Storage Units: Customers can have storage containers delivered to their location, fill them at their convenience, and have them transported to a secure facility.

-

Convenience for Urban Dwellers: This model caters to individuals in densely populated areas who require temporary storage during moves, renovations, or other transitions.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Limitations & Challenges in Self-Storage Market:

The growth of the self-storage market can be restricted by several factors, including:

- High Real Estate Costs: Acquiring or leasing property, especially in urban areas, can be prohibitively expensive, reducing profit margins or deterring new entrants.

- Zoning and Regulatory Constraints: Local regulations or zoning laws may restrict where and how self-storage facilities can operate, limiting expansion opportunities.

- Economic Downturns: In periods of economic recession, consumers and businesses may cut back on storage expenses, leading to lower demand.

-

Security and Liability Concerns: Issues such as theft, fire, or damage can lead to customer distrust, and liability concerns can increase operational costs.

- Seasonal and Temporary Demand: In some cases, demand may be seasonal (e.g., student storage) or driven by short-term needs, making long-term revenue streams less predictable.

- Competition from Alternative Solutions: Innovative storage options like portable storage, on-demand storage services, or shared economy models can draw customers away from traditional self-storage.

Expansion of E-commerce Sector: Market’s Largest Potential

Small businesses and online sellers often need flexible, affordable storage solutions for inventory, which self-storage facilities can provide. Many e-commerce sellers, especially on platforms like Amazon, Etsy, or Shopify, run operations from home and lack warehouse space. Self-storage units provide a cost-effective solution for storing products, packaging materials, and equipment. Self-storage facilities located in urban or suburban areas can serve as decentralized hubs for last-mile delivery, helping e-commerce companies reduce delivery times and costs. E-commerce businesses often face seasonal demand spikes (e.g., holidays, sales).

Temporary self-storage helps them manage overflow inventory without long-term warehouse leases. As online returns increase, especially in fashion and electronics, self-storage offers a flexible space for handling, inspecting, and repackaging returned goods.

“For instance, in January 2025, according to the data published by the National E-Commerce Association, with more than one-third of the world's population shopping online, the commerce sector is currently worth US$6.8 trillion and is expected to grow to US$8 trillion by 2027. Around the world, 2.77 billion people shop online from specialized commerce platforms or social media shops.”

Startups and small sellers value the month-to-month flexibility of self-storage over fixed warehouse contracts, helping them scale operations more fluidly. As e-commerce evolves toward faster, local deliveries, self-storage units can be adapted into micro-fulfillment centers with added tech, enabling quicker customer service. Self-storage companies can partner with e-commerce platforms or logistics providers to create bundled solutions for storage, shipping, and inventory management.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Regional Analysis:

North America’s Advanced Infrastructure to Promote Dominance

North America region held the largest share of the self-storage market in 2024, owing to advanced technology and high-tech self-storage developed in the region. Frequent relocations for work, education, or lifestyle reasons create continuous demand for temporary storage solutions. Urban residents increasingly live in apartments or smaller homes, especially in cities like New York, Los Angeles, and Toronto, boosting the need for off-site storage. High levels of consumer goods ownership result in more people using storage units to manage overflow items, collectibles, or seasonal gear.

The growth of online retail and small businesses increases demand for secure, cost-effective storage for inventory and supplies. Key life events such as college moves, marriage, divorce, or retirement—are common and often require temporary storage solutions. With more people owning RVs, boats, and extra vehicles, there's growing need for specialized outdoor and indoor vehicle storage. North America leads in technology adoption within self-storage, including smart locks, mobile booking, and contactless access making storage more appealing and efficient. Self-storage is a well-established and widely accepted service in North America, making market penetration easier compared to other regions.

U.S. Self-storage Market Trends

In U.S. self-storage sector has seen heavy investment from real estate investment trusts (REITs) and private equity, spurring expansion and consolidation. Post-pandemic shifts have led companies to downsize office spaces, using storage for excess furniture, documents, or equipment. U.S. households own a high number of vehicles, including RVs and boats, which often requires secure, off-site storage.

Asia’s Rising E-Commerce Platform to Support Growth

Asia Pacific region is seen to grow at the fastest rate in the self-storage market during the forecast period. Massive migration to cities across countries like China, India, and Southeast Asia is creating demand for space-saving solutions as people live in smaller homes. Increased income levels and consumption lead to more personal belongings, boosting the need for extra storage space. High property prices in cities like Hong Kong, Tokyo, and Singapore result in small living spaces, making external storage a practical necessity.

- The booming online retail and small business sector in Asia Pacific region needs affordable storage for inventory, returns, and packaging materials. Western lifestyle influences, minimalism, and flexible living have introduced the concept of self-storage to new customer segments. Cities with large expatriate or migrant communities (e.g., Singapore, Dubai, Hong Kong) see higher mobility and temporary storage needs.

- New self-storage facilities are integrating mobile apps, digital access control, and contactless services to attract tech-savvy consumers. Post-COVID changes in work culture have led companies to downsize offices, using storage units for furniture and files. International operators and REITs are entering emerging Asia Pacific markets, bringing capital and industry expertise.

Segment Outlook

Unit Size Insights

The medium segment dominated the self-storage market with the largest share in 2024. Medium units are ideal for a wide range of needs whether it's storing the contents of a 1–2-bedroom apartment, seasonal items, or small business inventory making them appealing to both residential and commercial customers. They offer a good balance between cost and space. For many users, especially in urban areas, they provide enough room without the higher price tag of large units. As more people move to cities and live in smaller apartments or condos, they often need extra space for belongings that don’t fit at home. Many small businesses use medium storage units for inventory, documents, tools, or equipment supporting steady demand from the commercial sector. Medium units are the most common choice during life transitions like moving, renovating, or temporary relocations.

The large segment is anticipated to witness lucrative growth during the forecast period. Small businesses, e-commerce sellers, and contractors increasingly use large units to store inventory, tools, office equipment, and seasonal supplies. Families undergoing renovations, relocations, or downsizing often need to store entire rooms of furniture, driving demand for larger units. Many customers use large units to store motorcycles, ATVs, small boats, or bulky equipment, especially in areas where outdoor storage is restricted. As companies downsize offices or switch to remote work, they store excess furniture and documents in larger units temporarily or long-term.

Consumers are learning to use fewer, larger units instead of multiple small ones for convenience, accessibility, and cost-efficiency. Storage providers are targeting corporate clients with tailored large-unit solutions, often under longer-term contracts, ensuring steady demand. Demand is rising for large, climate-controlled units to protect valuable goods like electronics, artworks, or inventory, further expanding this segment. Larger units often offer better value per square foot, attracting price-conscious users who want more space for less.

Some customers use large units for hybrid needs—combining personal storage (furniture, heirlooms) with business storage (products, documents). Cities with transient populations (students, expats, renters) see strong demand for large units to manage full household moves.

More Insights in Towards Packaging:

- U.S. Food Storage Containers Market: https://www.towardspackaging.com/insights/us-food-storage-containers-market-sizing

- Australia Warehouse and Storage Market: https://www.towardspackaging.com/insights/australia-warehouse-and-storage-market-sizing

- U.S. Cardboard Storage Boxes Market: https://www.towardspackaging.com/insights/us-cardboard-storage-boxes-market-sizing

- Food Storage Container Market: https://www.towardspackaging.com/insights/food-storage-container-market-sizing

- Reusable Transport Packaging Market: https://www.towardspackaging.com/insights/reusable-transport-packaging-market-sizing

- Disappearing Packaging Market: https://www.towardspackaging.com/insights/disappearing-packaging-market-sizing

- Sachet Packaging Machines Market: https://www.towardspackaging.com/insights/sachet-packaging-machines-market-sizing

- Reusable Water Bottles Market: https://www.towardspackaging.com/insights/reusable-water-bottles-market-sizing

- Disposable Food Packaging Market: http://towardspackaging.com/insights/disposable-food-packaging-market-sizing

- Disposables Packaging Market: https://www.towardspackaging.com/insights/disposables-packaging-market-sizing

Application Insights

The personal segment accounted for the largest self-storage market share in 2024. Events like moving, marriage, divorce, downsizing, or bereavement often require temporary or long-term storage of household items. In cities where housing is compact and expensive, people use self-storage to compensate for lack of in-home space. Many individuals accumulate more belongings than they can store at home, seasonal items, furniture, sports gear, collectibles, etc., creating demand for off-site storage. Students, military personnel, expatriates, or digital nomads often need storage while away from home for extended periods.

Enthusiasts of hobbies like cycling, skiing, or DIY often store bulky or seasonal equipment in self-storage units. Self-storage is commonly used to store cars, RVs, boats, or motorcycles, especially in places with HOA or parking restrictions. Storage units offer a flexible and low-cost alternative to upsizing a home, appealing to a wide range of income levels.

The business segment is anticipated to show the fastest growth during the forecast period. Online retailers, startups, and home-based businesses use self-storage to manage inventory, packaging materials, and returns, without the overhead of renting warehouses. Compared to commercial leases, self-storage offers affordable, scalable space with flexible terms, which appeals to small and medium-sized enterprises (SMEs). Post-pandemic shifts have led many companies to reduce office space, using storage units for surplus furniture, documents, or equipment.

- Businesses involved in seasonal products, pop-up shops, or events use storage units to manage inventory fluctuations efficiently. Law firms, clinics, and corporations need secure off-site storage for physical records, especially in industries with compliance requirements.

- Contractors, plumbers, electricians, and other mobile service providers use storage as a base to store tools, parts, and equipment. Rising rents in urban areas make self-storage an attractive alternative for overflow space, especially for businesses needing central but affordable locations.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results—schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in Global Self-Storage Market:

- In April, 2025, S Jones Containers, a leading sale, hire, and conversion provider, is about to introduce ClearRestore, a cutting-edge and first-of-its-kind service that can return shipping containers' paintwork to almost new condition. S Jones Containers, a leading sales, hire, and conversion provider, is about to introduce ClearRestore, a cutting-edge and first-of-its-kind service that can return shipping containers' paintwork to almost new condition. Compared to the conventional method of repainting containers, ClearRestore can restore old and worn paintwork on shipping containers to nearly new condition using state-of-the-art products at a cost savings of 58% and with a much smaller environmental effect.

- In January 2025, NexPoint Storage VI DST, a Delaware Statutory Trust ("DST") offering, was launched by the multibillion-dollar alternative investment firm NexPoint. It consists of two Generation-V ("GenV"), Class-A storage facilities located in the Nashville and Washington-Arlington-Alexandria ("Washington DC MSA") metropolitan statistical areas ("MSAs"). The two GenV storage facilities will be run by Extra Space Storage, a top owner and operator of self-storage properties in the sector, and are situated in Temple Hills, Maryland, and Nashville, Tennessee. According to NexPoint, both areas provide alluring long-term investment prospects because of their advantageous demographics. A total of 1031 exchanges are eligible for the US$45 million offering. It has a US$100,000 minimum investment requirement and is available to accredited investors.

-

In February 2025, SmartStop Self-Storage revealed the release of the new SmartStop Self Storage Mobile App from REIT, Inc., a self-managed and fully integrated self-storage firm. By March 2025, the app, which was created to offer convenience and flexibility, will be accessible at all 210 SmartStop locations in the US and Canada. It has already been released in a few markets. Customers can use their cellphones to control their storage experience with the SmartStop Self Storage Mobile App. Important functions include the ability to rent new storage spaces, remotely unlock gates and doors, and manage accounts—all from the comfort of the smartphone. SmartStop keeps putting the smooth and easy-to-use client experience first by optimizing these procedures.

Global Self-Storage Market Top Players

- Public Storage

- Extra Space Storage

- U-Haul Holding Company

- National Storage Affiliates

- CubeSmart

- SROA Capital

- Prime Group Holdings

- Merit Hill Capital

- StorageMart

- The William Warren Group (WWG)

Global Self-Storage Market Segments

By Unit Size

- Small

- Medium

- Large

By Application

- Personal

- Business

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

-

Latin America

- Brazil

- Mexico

- Argentina

-

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Premium Global Insights @ https://www.towardspackaging.com/price/5494

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Our Trusted Data Partners:

Precedence Research | Statifacts |Towards Automotive | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Distribution channels: Consumer Goods ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release